As most people near retirement – or at least start to dream about it – they begin to ask themselves questions that they have probably been avoiding or pushing off for years.

Do I have enough?

When should I take my pension or social security?

Can we afford to go somewhere different during the winter months?

What should I anticipate healthcare costs to be?

All of these questions lay the foundation for one of the most important decisions you will make in your lifetime – when to retire. The last thing you will want to do is retire and figure out the answer to these questions afterwards. That could be very scary and stressful. After all, retirement is supposed to be stress-free and enjoyable – at least that is what all the commercials say! So how do you prepare yourself to for that next chapter in your life? It is very simple; it is to build a Financial Plan. This is the first post of a many dedicated to the importance of having a financial plan.

According to Princeton Survey Research, 69% of retirees have not done a comprehensive financial plan to prepare themselves for retirement. WOW! This blows me away. Many people have worked all their lives to prepare themselves for this new journey, yet most are not willing to put in the time to make sure they will have enough money, will they run out of money or how do they distribute their assets in the most effective way. Imagine someone told you to get in your car and drive to Mexico without a map, directions or signs – could you do it? Possibly, however, you probably had a few bad decisions or wrong turns along the way and hopefully you did not run out of money for gas.

The point I am trying to make is very simple – many of you could make it through retirement without a financial plan and not run out of money, however, you probably could have done a few things smarter and potentially with less risk. The question you all need to ask yourself is – am I willing to put in a minimal amount of time and effort to work with someone to develop a financial plan that helps my family live smarter in retirement? I hope most of you answer yes!

Let’s cut to the chase and talk about specifically what a financial plan can do for you. Oftentimes, the biggest misconception about a plan is that it is just a basic income projection to determine if you will run out of money or not. Many plans will use unrealistic assumptions like returning 6% year after year. A financial plan is a working document that serves a map to point you in the right direction as you proceed through life. A good financial plan should be proactive and present future roadblocks before you hit them. Things like taxes, income needs, rate of return and risk all change over time. Being able to update and see how all these variables affect your plan is the true value in having one.

In my experience most people do not want to know how much money they can leave to their beneficiaries – they want to know how much risk they have to take so they can live through their retirement without unnecessary risk and volatility. Imagine if there was a strategy to distribute your assets with while paying less taxes or maximizing the total amount of Social Security between you and your spouse. This is what a financial plan does. You are able to look at all possible variables to determine how they all affect each other and see which the smartest decision for you going forward is.

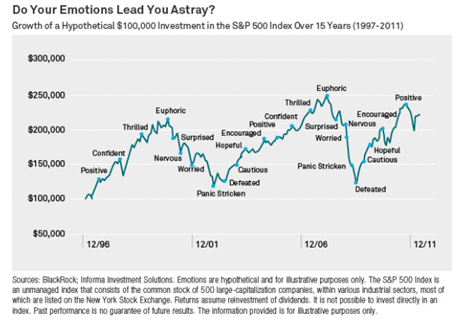

Financial plans can also provide additional advantages for people planning for retirement that have nothing to do with money but everything to do with our emotions. Going through the exercise to develop a plan is fantastic; however, sticking with it becomes the difficult part – especially when we become emotional.

We as humans are creatures of habit and all have similar traits in some respects. When it comes to behavior and emotions, oftentimes this is even truer. Our emotions swing from being really excited and overly optimistic when something great happens to depressed and lethargic when things do not go our way. Our emotions cause us to veer off the trail of our financial plan when things do not go exactly according to plan.

Financial planning is a process or a working document, once it is completed you do not leave it on the shelf to collect dust. It needs to be reviewed annually to assure you are still on the right track, but more importantly, you need to stick with it. Emotionally this is tough to due. I am going to talk briefly about a few common behaviors that the typical person encounters when making financial decisions.

Following the Crowd

“So and so said to buy xyz stock because his cousin has owned it and made a bunch of money.”

“They said the market is going to going to crash.”

These are comments I hear all the time and my first response is usually, “Who is They?”

Following the crowd is usually precedes a market crash. In the late 90s, everyone was telling everyone to buy technology stocks. In the middle 2000s, everyone was borrowing as much money as they could so buy real estate. From a behavioral standpoint, the same mistakes were made. People were following the crowd without looking at their financial plan or having a basic strategy of how they were going to handle these particular investments based on a good or bad outcome. Neither situation turned out well for those who invested in these times without a basic plan.

As you plan for retirement, you need to determine the amount of risk you need to take as a family to achieve your goals and not follow the actions of others. The last thing someone needs to do prior to retirement is take unnecessary risk. Proper planning will help you determine your risk tolerance so you know what investments are suitable for your situation. Even if you do want to follow the crowd on a specific idea, a plan would at least help you determine how much you can afford to risk or lose.

Fear and Greed

When markets go up you become over confident and think the markets will continue to go up. It is almost like feeling invincible. Then when the markets go down we get scared and don’t want to lose our money. Buying high and selling low is not a viable investment strategy. This behavior alone is the main reason investors should have a well-defined risk tolerance and asset allocation strategy so they are able to stick with their investments during all market conditions. A financial plan helps you avoid this demon from destructing your wealth because you have written investment policy for your money. According to Dalbar and Associates, the average investor returns less than have the S&P 500 over the last 20 years. This behavior mistake has been the primary reason for that.

Confirmation bias

This is simply finding or believing information that supports your opinion. If you think the markets are going to do down, you will only look for or read information that confirms your preconceived opinion that the markets are going to go down. You must take an unbiased approach to investing or will get caught taking too much risk believing your opinion. The media does a fantastic job of manipulating our minds when it comes to confirmation bias. I’ll touch on media in a second.

Hindsight

“I saw this crash coming in 2008 and wish I would have sold.”

“If I only would have put more money in that stock I would be rich and retired.”

If I had a nickel for everything I have heard that I would be retired!! This is a thought that is unavoidable and we all have experienced. We can’t dwell on the past, only focus on the future. Use your energy and efforts to help improve future results. The past is only the past.

Media

At some point I will do a whole post on the affects media has on investors. To be brief for this post, keep in mind that the media does not have your best interest at heart. Their job is not to help you make more money or take less risk; their job is to sell advertising. They use all these behavior finance mistakes against you to increase their ratings. Little is done to hold media accountable to what they say or do. Although media can provide some guidance from time to time, rarely is it specific to one person or group. Follow your financial plan, not the media.

I have just wrote about how emotions that can ruin a person’s retirement if they do not harness their behaviors appropriately. A financial plan alone will help you elevate some of these mistakes assuming your follow your plan. This is where a Financial Advisor can help. A good Financial Advisor should not only help you create your plan, but make sure you do not fall victim to your own demons and see that plan through. One emotional lapse could wreck years of hard work. Proper advice and guidance should shepherd you those emotional times and keep you focused on the end goal.

Hopefully I have driven home my point to everyone. I am very passionate about this topic. Please take the time to plan for you and your families’ future as there is really no excuse not to.

Matt Gulbransen, AWMA, is a Financial Planner in the Minneapolis/St. Paul metro area. He works with pre-retirees and retirees to help prepare them for retirement. He has offices in Woodbury and Apple Valley, MN.