Wednesday January 14, 2015

2015 Market Outlook

Happy New Year everyone! Changing of the calendar year allows most of us to reflect on what we have accomplished or wished we accomplished over the last year. It also provides us the opportunity to think about the year ahead and what opportunities, challenges and changes we all will face.

The real reason for this note, is to provide some perspective on the markets as we head in to 2015. No one truly knows how this year will play out, but here are some comments from me:

Oil prices- We all have now noticed $2/gallon gas at the pump – or less! I saw $1.85/gallon in Apple Valley on 1/12. This should further help our retail economy in the US. GDP, which measures growth of our economy, was up 5% last quarter. Historically, this is a very positive number. Low gas prices should provide a few more dollars in the pockets of consumers, which in turn most will spend. In my opinion, retailers, restaurant and entertainment will benefit the most.

Low oil prices are not necessarily good though. Many foreign and emerging market countries heavily rely on higher oil prices to support their economy. If these prices continue longer term, it could put pressure on the global economy.

Another factor that most don’t realize is that energy companies tend to carry a lot of debt on their balance sheet to fund exploration, pipelines and growth activities. With $100+/barrel oil six months ago, many energy companies were trying to expand rapidly. They did this by borrowing money and issuing bonds. This could present an issue a year or two from now if oil stays this low.

In summary, good for consumer and good for economy now. If it lasts long-term, there may be some concerns of the financial health of the companies that are carry lots of debt. It is also a concern for those countries heavily dependent on oil. Essentially low oil prices is a double edged sword for the stock market.

Interest Rates – The US 10-year Treasury rate is 1.97% as of 1/7/15. We are not being paid to invest anywhere else. Until this changes, we remain optimistic about US stocks. I would also remain positive about real estate since mortgage rates are remaining near all-time lows. Look for lots of new development in 2015.

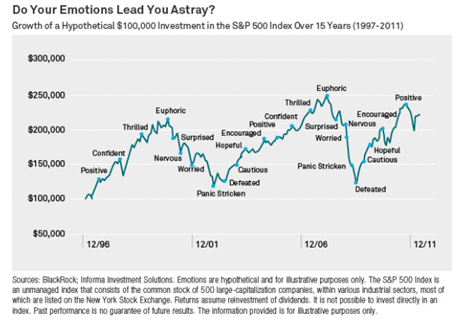

Emotions and Behavior – The markets move on fear and greed – that never changes. Each year, media plays a bigger role influencing our investment decisions – not always for the good. Every small move in the market seems like it needs to be justified today. Remember this is the nature of markets, they don’t go straight up or straight down. Most minor moves are usually driven by investor emotions.

Below is a chart from Blackrock showing the emotions of investors over the past 15 years. This is good to keep in mind.

We remain positive about the environment, however, things can change and that is what we are here for. Again, thank you for the opportunity to serve you. We wish you the best in 2015.

Regards,

Matt Gulbransen